The all-cap value style ranks sixth out of the twelve fund styles as detailed in my style roadmap. It gets my Neutral rating, which is based on an aggregation of the ratings of 2 ETFs and 285 mutual funds in the all-cap value style as of July 18, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are here.

Figure 1 ranks from best to worst the two all-cap value ETFs and Figure 2 shows the five best- and worst-rated all-cap value mutual funds. Not all all-cap value style ETFs and mutual funds are created the same. The number of holdings varies widely (from 14 to 2039), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the all-cap value style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the all-cap value style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Only 2 All-cap Value ETFs

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Four mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

iShares Russell 3000 Value (IWW) is my top-rated all-cap value ETF and FundVantage Trust: Formula Investing US Value Select Fund (FNSIX) is my top-rated all-cap value mutual fund. IWW earns my Neutral rating and FNSIX earns my Attractive rating.

First Trust Multi Cap Value AlphaDEX Fund (FAB) is my worst-rated all-cap value ETF and Trust for Professional Managers: Snow Capital Opportunity Fund (SNOAX) is my worst-rated all-cap value mutual fund. FAB earns my Neutral rating and SNOAX earns my Very Dangerous rating.

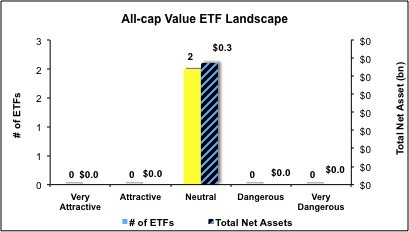

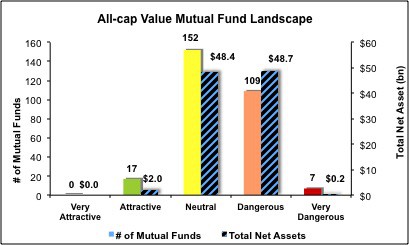

Figure 3 shows that 501 out of the 2198 stocks (over 35% of the total net assets) held by all-cap value ETFs and mutual funds get an Attractive-or-better rating. However, neither of the two all-cap value ETFs and 17 out of 285 all-cap value mutual funds (less than 2% of total net assets) get an Attractive-or-better rating.

The takeaway is: all-cap value mutual fund managers pick too many low-quality stocks.

Figure 3: All-cap Value Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering all-cap value ETFs and mutual funds, as 98% of the total net assets invested in all-cap value mutual funds is allocated to Neutral or Dangerous funds. No ETFs and only 17 mutual funds in the all-cap value style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Accenture PLC (ACN) is one of my favorite stocks held by all-cap value ETFs and mutual funds and earns my Very Attractive rating. Accenture is a steady value creator. Since 2007, ROIC has been consistently in the 40-50% range, placing Accenture among the elite when it comes to the efficiency and profitability of their business model. Accenture is well-known as an industry leader by boosting efficiency and creating value for their clients. Their operating results indicate that they are doing the same thing for their own shareholders. A consistently profitable business like Accenture is a great stock to pick up when Mr. Market serves up an attractive price, and that is certainly the case right now. ACN’s current share price (~$58.60) implies that the company’s after-tax profits (NOPAT) will decline by 10% permanently. Those pessimistic expectations give ACN an attractive risk/reward profile.

Ashland Inc. (ASH) is one of my least favorite stocks held by all-cap value ETFs and mutual funds and earns my Very Dangerous rating. Ashland operates in cyclical industries, which means that when sales are growing, they need to be poised to capitalize, because there are sure to be tough years ahead. Results through the second quarter of ASH’s 2012 fiscal year have provided some hopeful revenue growth, but the company has failed to deliver solid returns. Here’s why: over the past several years ASH’s ROIC has stair-stepped downward from 5% in 2007 to a measly 1.4% last year. ASH’s bulging balance sheet has failed to deliver new profits. Furthermore, their pre-tax operating margins have languished, averaging around 4% over the same period. It’s crucial for cyclical companies like ASH to be efficient so that they can strike in the fat years and weather the lean ones. ASH has been on a steady decline in capital efficiency and operating margins, so it’s tough to see why the market has such high expectations. To justify its current stock price (~$69.60), ASH would need to grow its profits 20% compounded annually for the next 15 years. High expectations and stagnant operating efficiency drive ASH’s Very Dangerous rating.

Figures 4 and 5 show the rating landscape of all all-cap value ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 2 ETFs and 285 mutual funds in the all-cap value style.

Disclosure: I own ACN. I receive no compensation to write about any specific stock, sector, style or theme.