The

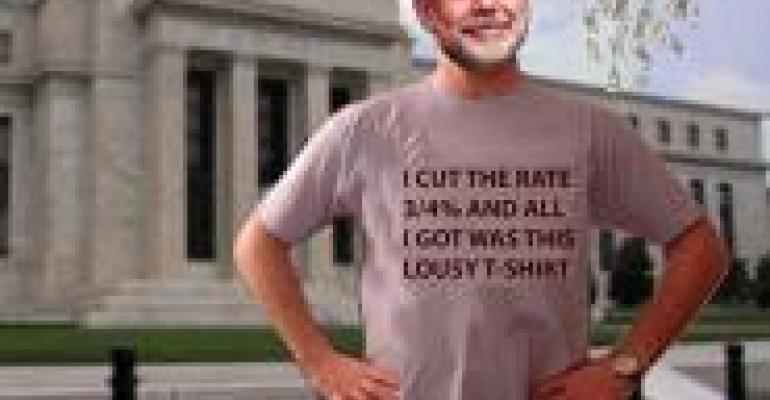

FT’s chief business columnist has a nice take on Ben Bernanke’s speech yesterday, about how it the credit crisis was caused by “exotic” mortgages and NOT easy money policies of the Fed.

The

FT’s chief business columnist has a nice take on Ben Bernanke’s speech yesterday, about how it the credit crisis was caused by “exotic” mortgages and NOT easy money policies of the Fed.

FT Columnist John Gapper notes that the 30-year fixed mortgage is rare outside the United States and that what a wonderful instrument it is indeed, especially given the favorable tax treatment awarded to mortgage interest.

Gapper concludes:

“One of the strange things about the housing bubble in the US is how mortgage brokers managed to push so many people away from 30-year fixes towards weird forms of adjustable-rate loans.”

In short, I think Gapper is rightly insinuating that it was a classic speculative frenzy: People—institutions as well as individuals—were over-reaching, buying more real estate or house than they otherwise would have. The fancy mortgage products—Bernanke yesterday mentioned interest-only ARMs, negative amortization ARMs and pay-option ARMs—were the real culprits, because they enabled home buyers to over-leverage to get in on the house-buying panic. Put another way, the increasing use of exotic mortgages was a cause of “the associated decline of underwriting standards,” Bernanke said yesterday in his speech to the American Economic Association annual meeting.

I disagree with Bernanke, though, that regulators can prevent speculative manias in the future. Credit default swaps, even if they had been traded through a centralized clearing-house, might still have been mispriced, because housing investments were simply not considered to be risky.

I have yet to hear a good antidote to prevent future bubbles—that is a cure that won’t slow economic growth and stifle financial intermediation. New regulations will likely only create another round of cat-and-mouse games, where financial institutions in seeking profits, attempt to arbitrage their way around regulations.