Among sports memorabilia, a baseball signed by one of the presidents of the United States has become quite the valuable niche, with some autographed balls fetching tens of thousands of dollars. For instance, baseballs signed by President John F. Kennedy can fetch up to $40,000 apiece, MarketWatch reports, while those of presidential hopefuls are not quite as valuable. A ball signed by former Secretary of State Hillary Clinton is the most valuable, worth about $300, while a Bernie Sanders ball is worth $75. Among the Republican hopefuls, Donald Trump’s autograph on a baseball is worth $250, followed by Ted Cruz at $175. A ball signed by former Florida Gov. Jeb Bush is worth only $40, followed by that of Ohio Gov. John Kasich at $35, according to JustCollecting.

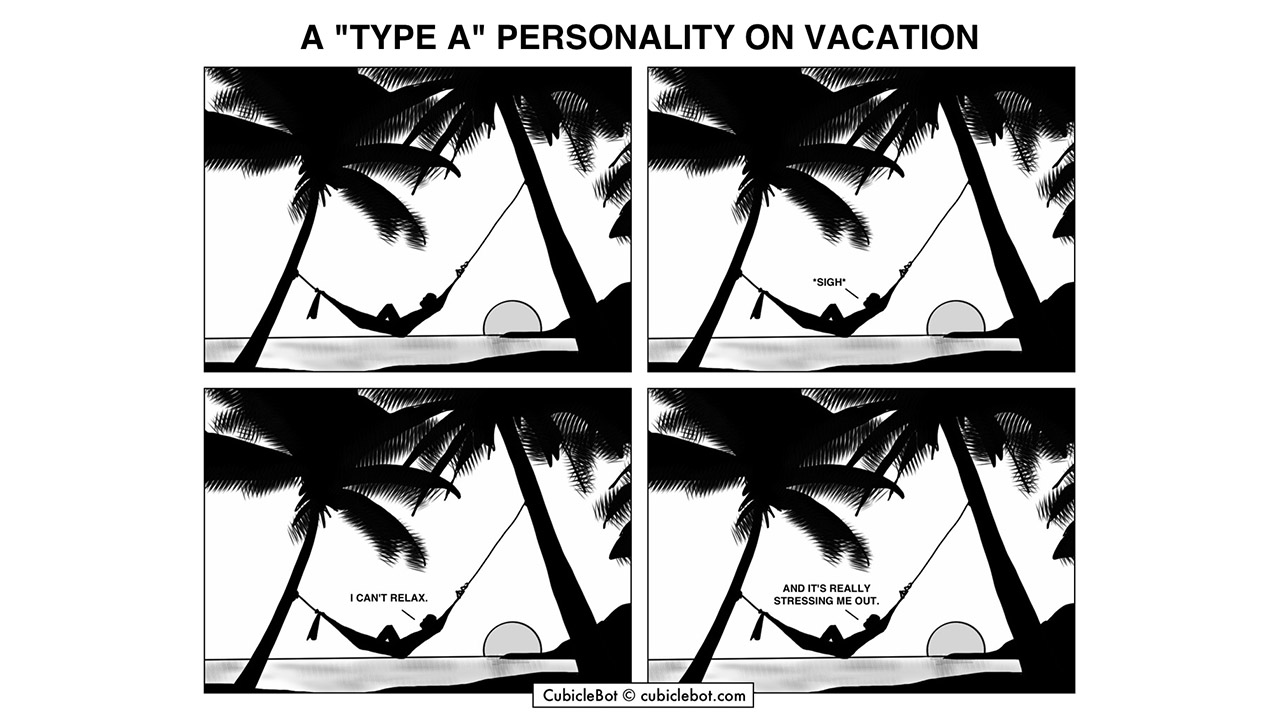

Many advisors wear the “Type A” label with secret, or sometimes not so secret, pride. Entrepreneurial, hard-charging advisors who build practices with bravado and a firm handshake, and meticulous organization, planning and processes will often humblebrag about their Type A inclinations. But the origins of the term suggest it’s not something to embrace, according to this deep dive on the Priceonomics blog. The man who came up with the label was a cardiologist describing consistent behaviors among patients who suffered from heart attacks, strokes and coronary disease. These patients showed “intense, sustained drive to achieve self-selected but usually poorly defined goals,” had a “profound inclination and eagerness to compete” and exhibited a “persistent desire for recognition and advancement.” The idea of linking thought patterns to heart health was revolutionary at the time, though the Type A meme was boosted into public consciousness by the cardiologist’s best-selling book in the 1970s and backing by tobacco companies looking to find other causes of cancer.

With the Department of Labor’s fiduciary proposal working its way through a final review, advisors across all channels are re-evaluating their retirement business models. To help simplify the process, TD Ameritrade Institutional teamed up with an ERISA (Employee Retirement Income Security Act of 1974) consultant to provide its advisors with a compliance guide. RIAs on the custodian’s platform will receive a 30 percent discount on the Pension Resource Institute’s RetirementAdvantage program. The platform provides firms with service models and all the necessary documentation templates needed to service retirement plans, as well as access to ERISA lawyers and compliance specialists who can implement and customize the services as needed.

If your client isn’t excited about the challenge of expanding their wealth through hard work and smart investment, then maybe it’s time to play matchmaker. Unfortunately, over 90 percent of ultra high-net-worth individuals are already married, so rich love can be hard to find. Never fear, however, as Wealth-X has your back with its recent list of the 10 most eligible wealthy bachelors and bachelorettes in the world. The list ranges from 24-year-old real estate heiress India Rose James, whose interests include fashion and nightlife, to 60-year-old Saudi royal Al Waleed bin Talal bin Abdul Aziz Al Saud, who enjoys bespoke suits and yachting—so there’s a flavor for every taste.