This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rulesprovide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

Accumulated other comprehensive income (OCI) are gains and losses that have yet to be recognized, and are excluded from net income. The accumulated OCI item usually appears as a separate line item on the statement of shareholder’s equity. When OCI charges can be recognized, they are removed from OCI, reported on the income statement and recorded in net income.

Most investors would never know that accumulated other comprehensive income distorts GAAP numbers by raising or lowering reported assets and, therefore, distorting assessment of a business’ ability to generate a return on that capital. Examples of items in OCI include: unrealized gains/losses on for-sale securities, derivatives and cash flow hedges; gains and losses from the translation of financial statements of foreign subsidiaries; actuarial gains and losses on benefit plans; and changes in a firm’s revaluation surplus. We remove OCI from our invested capitalcalculation to (1) better represent the actual capital on hand for management to generate a return on and (2) avoid the noise from the fluctuations of OCI.

Berkshire Hathaway (BRK.A) from Figure 1 has accumulated a large amount of other comprehensive income over the years, to the tune of $28 billion. While invested capital usually reflects the total amount of equity in a business, we subtract accumulated OCI from our invested capital calculation, as it has not yet been recognized in the P&L account or used in generating profit. This adjustment resulted in an invested capital of $255 billion for BRK.A, as opposed to $283 billion if accumulated OCI was included.

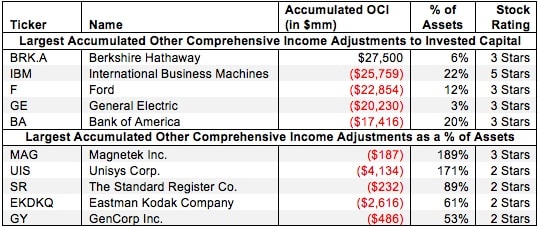

Figure 1 shows the five companies with the largest (gross value and as a % of total assets) accumulated other comprehensive income/(loss) adjusted out of invested capital for 2012.

Figure 1: Companies Most Affected By Accumulated Other Comprehensive Income

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

However, these companies are far from the only ones affected by accumulated OCI. In the last fiscal year, adjustments for other comprehensive income occurred for 2,509 different companies, resulting in a total adjustment values of $504 billion back into invested capital and $179 billion out of invested capital. Our database contains over 29,526 OCI adjustments for a total adjustment value of $3.4 trillion back into invested capital and $1.3 trillion out of invested capital.

Though the removal of other comprehensive income can decrease invested capital and raise the return on invested capital (ROIC), it does not always mean the company’s stock will earn a favorable rating. For instance, Berkshire Hathaway (BRK.A) still has only a 3-star or Neutral rating despite its $27 billion adjustment out of invested capital. The opposite is also true. While IBM (IBM) had $26 billion added back to its invested capital, it still receives a 5-star, or Very Attractive Rating.

In other cases, however, OCI can artificially depress invested capital, raise ROIC and make a stock look overvalued. Case in point: Unisys Corp. (UIS) had a total of $4.1 billion in OCI adjustments in 2012.

This $4.1 billion was a loss that was recorded on UIS’s consolidated balance sheet as accumulated other comprehensive income. If this amount had been treated as a loss of equity and recorded in invested capital, Unisys’ invested capital calculation would have been just $1.2 billion and its ROIC boosted to 24%, putting it in the top quintile of all companies I cover. Instead, we add back this loss to our invested capital calculation to find the true amount of capital used in generating profit for UIS.

After this adjustment, UIS has an invested capital of $5.4 billion and an ROIC of just 5.5%, making it look far less attractive. Our clients would receive a very different picture of UIS had this adjustment not been made. Diligence pays.

André Rouillard and Sam McBride contributed to this report.

Disclosure: David Trainer, André Rouillard and Sam McBride receive no compensation to write about any specific stock, sector, or theme.