The asset management industry has seen little recovery since the crisis, with revenues hovering at 2008 levels and asset growth stalling. But there’s a new threat to asset managers’ profitability that’s exacerbating the problem—the wirehouses.

“For years, we’ve been talking about the shift in product mix from higher-fee active assets towards fixed income and passive assets that obviously come in at lower fees,” said Gary Shub, partner at Boston Consulting Group and lead author of the firm’s new report titled Capturing Growth in Adverse Times: Global Asset Management 2012. Shub spoke about the report’s findings at a press briefing in New York Thursday.

“For the first time, we are actually seeing pressure on fees in the U.S. market, and it’s being driven really by the trade—the distributors, and in this case, primarily the four wirehouses that hold about half the retail managed assets in the market.”

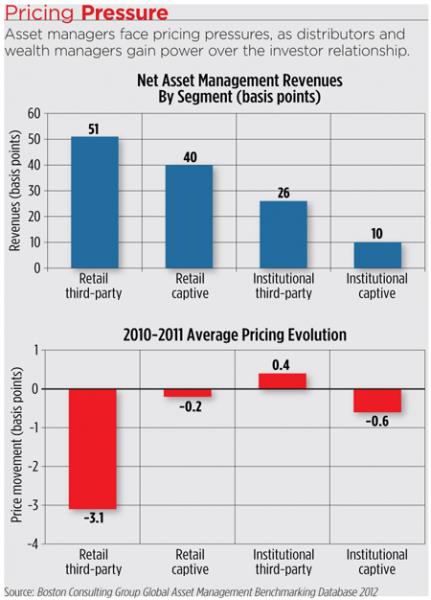

Distributors, such as the wirehouses, are in a greater position of power than they were in the past, Shub said. They own more of the relationship with the end investors, and therefore are demanding a higher portion of the revenue that asset managers are generating. Specifically, the wirehouses or retail intermediaries that traditionally captured a share of the revenue—such as 10 basis points on fixed income products and 25 basis points on equity products—have attempted to boost their share by at least 5 basis points, Shub said. Most of the wirehouses have been successful in doing so, he added.

In addition to revenue splits, there is pressure on pricing. Even with the move towards lower-fee passive funds, pricing has, historically, remained relatively stable. But in 2011 pricing pressures have emerged in some segments, including third-party retail and captive retail, BCG said. (See chart below.)

Partially, this is because the distributors at the wirehouses are consolidating and reducing the asset managers they work with and allow into their managed programs or model portfolios, Shub said. Those managers that they do let in have to negotiate some price concessions.

Partially, this is because the distributors at the wirehouses are consolidating and reducing the asset managers they work with and allow into their managed programs or model portfolios, Shub said. Those managers that they do let in have to negotiate some price concessions.

“So they’re offering the asset managers more volume, but in exchange, they’re demanding lower fees and higher return.”

The amount of those price concessions is less clear, Shub said, but he does know that the distributors are extracting a discount of a few percentage points.

Passive is King, Even for Bonds

A continuing threat to traditional active managers is the shift toward passively managed funds, which grew market share from 7 percent in 2003 to 12 percent in 2011. According to BCG, the rise of ETFs account for much of that: ETF assets have grown from $800 billion at the end of 2007 to $1.3 trillion in 2011.

Because passive products are priced much lower, so are the revenues of asset managers that offer them, said Monish Kumar, senior partner at BCG and leader of the financial institutions practice in North America.

Actively-managed fixed income funds, which have of late been the one safe spot from the move toward passive funds, is also now under attack, BCG said. Passively managed fixed income saw $38 billion and $50 billion in net new flows in 2010 and 2011, respectively.

“Particularly in domestic or plain vanilla fixed income, passive has become a real threat to those markets,” Shub said.

In addition, low interest rates are expected to reduce the returns and attractiveness of fixed income securities going forward; government bonds are no longer perceived as “risk-free,” liquid investments, pushing investors towards specialized products like credit, high yield and emerging market debt.

View from the Sidelines

Growth in the global asset management industry remained flat, with net new flows of only 0.1 percent in 2011. Global AUM was $58.3 trillion at year-end, compared with $58.8 trillion in 2007. In North America specifically saw no growth in 2011, ending with $27.7 trillion in AUM, compared to $28.8 trillion in 2007.

The good news is that investor wealth has grown 2 percent since 2007, Shub said. Meanwhile, the portion of their assets managed professionally for a fee stayed flat at $49.7 trillion.

Why the gap? Investors continue to stock away assets in cash. In fact, since 2007 investors have put $9.7 trillion into their household cash accounts.