“Do yourself a favor: Go open a digital advice account,” Scott Welch, chief investment strategist at Dynasty Financial Partners, challenged advisors at IMCA’s (Investment Management Consultants Association) annual conference in Orlando, Fla., on Tuesday morning. “Then go and back-test that portfolio of ETFs against your own client portfolios; it’ll likely hold up just fine. So what are you going to say when you client asks, ‘Why am I paying you 90 basis points more than this robo?’"

The answer, Welch said, will not be because you deliver that much more in alpha. Advisors will have to better define their value beyond investment performance. For one, incorporating behavioral finance and goals-based planning into client portfolios can be a positive differentiator.

“You have to become like Starbucks,” Welch said.

Welch said he will pass up free coffee to pay $4 at Starbucks. Why? He likes the experience of going to Starbucks. Similar to the way others like Nordstrom, the Ritz Carlton and Disney have done, Starbucks figured out how to take a commoditized product and make a better client experience so that people will pay a premium for it. Advisors ought to do the same.

Take performance reporting, for example. This is the single most tangible thing advisors give to clients. Welch said advisors should turn it into wisdom and guidance, not just data.

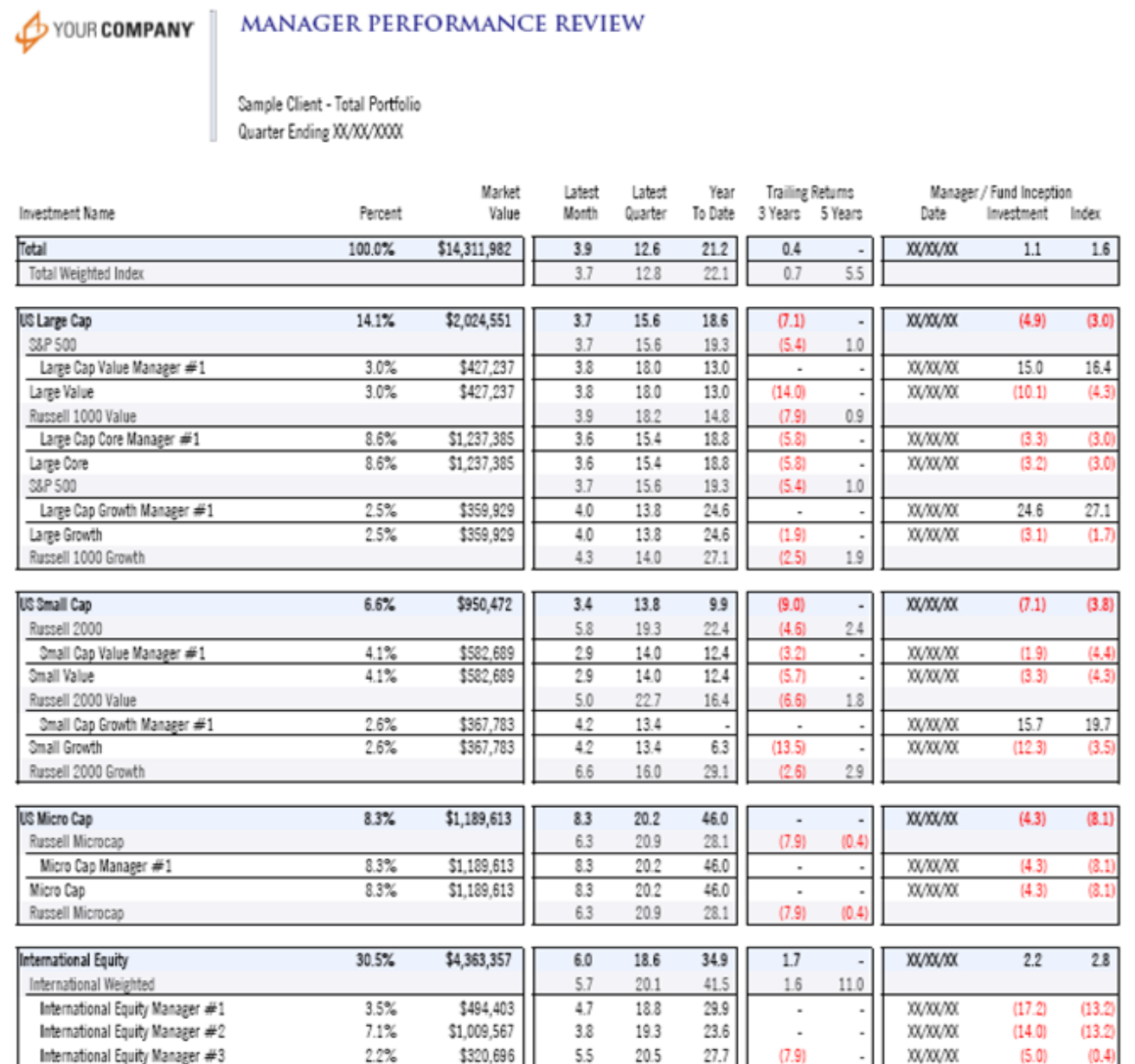

This is what the typical performance report looks like:

In this performance report, the first thing the client is going to look at is the most recent performance, but is that what should matter? They also see a lot of red. Advisors may be having the wrong conversation with clients; this report encourages short-term thinking, anchoring to irrelevant benchmarks, mental accounting and a focus on returns rather than risk. There’s no indication of how the client is progressing toward their financial objectives, and there’s little explanation as to why they're in these investments.

Advisors are taught to think in terms of what’s in the portfolio, i.e., small cap, large cap, value, growth, international stocks, fixed income. But you need to instead talk to clients about why these are in the portfolio, Welch said.

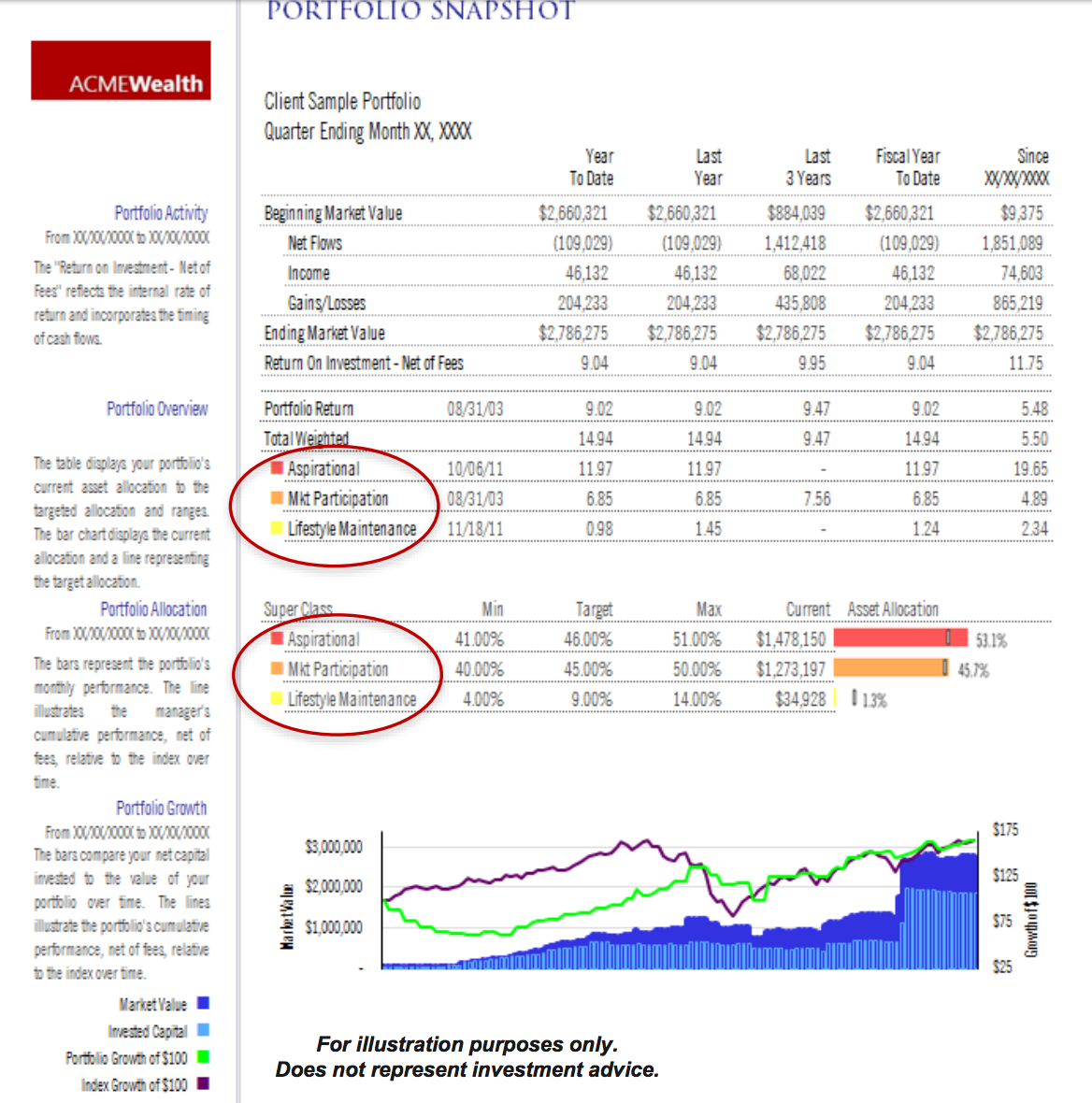

What should a performance report look like? It should provide a picture of how the client is doing relative to the agreed-upon plan. The advisor may need the data to see how the client is doing, but unless the client has been taught the technical concepts such as standard deviation, they don’t need to see it. Welch provides this example:

The industry defines alpha as the excess performance of active managers. But Welch argues that it is anything an advisor does for their clients that they ascribe value to and are willing to pay for. Fees and taxes, for example, are areas that can be optimized to provide alpha to your clients.