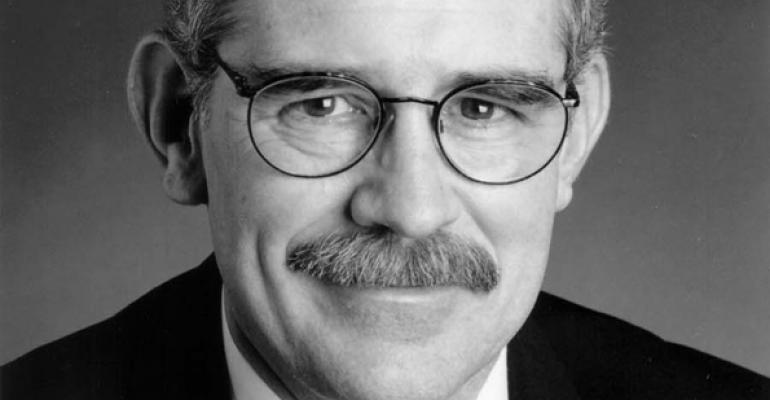

Evidence of the disturbance in the credit markets -- wrought by a combination of flight-to-quality asset commitments and Fed intervention -- can be seen in the spread between the ten-year Treasury rate and the S&P 500 dividend yield.

In good times, Treasuries offer investors a premium; in bad times, not so much. Over the past decade, the average government yield was 1.7 percent higher than the benchmark’s dividend. More recently, however, the Treasury rate’s been below the S&P payout. At March’s month end, in fact, ten-year paper represented a 12 basis point discount (see chart below) to equities. The question for technicians is whether the double-bottom established in the second half of 2012 will be a springboard to higher rates, much as the pan-scraping discounts in late 2008/early 2009 vaulted the Treasury/SPX spreadupward nearly 300 basis points.

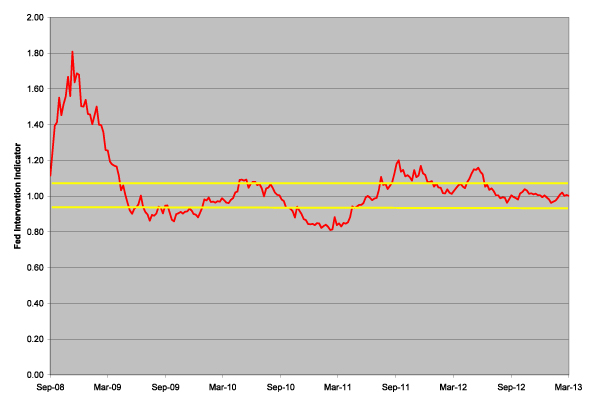

Given this, what are the odds the Fed will make a move to hike rates?

Not likely in the near term. Threading the needle has been Ben Bernanke’s recent pastime, at least as indicated by the Fed Intervention Indicator (see below). The likelihood of a Fed open market action increases as the red indicator line crosses above or below the yellow lines at the 1.05 and .95 levels.

A move above 1.05 should prompt the Fed to cut rates or take some other accommodative action. A decline below the .95 level, on the other hand, is inflationary and ought to cause the Fed to consider pushing up interest rates.

After several months of lead-footed moves, Bernanke & Co. seems to have found a sweet spot (the Fed Intervention Indicator’s now hugging the 1.00 level). Without wholesale shifts in commodity prices or interest rates, there seems little to motivate the Fed to move off its dime.