Socially responsible and values-based investing is a charged subject. Many veteran financial types view the concept as, well, inherently stupid; others find it compelling. Common objections include the challenge of using non-investment metrics (values) to drive investment returns, the decision about which and whose values to consider, and whether the category can deliver decent risk-adjusted returns.

Despite this friction, the idea of responsible investing (faith-based, values-oriented, and other squishier” screening models) has been around for a long time and has garnered billions in assets globally. More than 650 firms worldwide have signed the United Nations Principles for Responsible Investment, representing more than $18 trillion in assets. Signatories include asset managers, investors (pension funds, primarily) and industry service providers. (Full disclosure: My firm, Momentum Partners, has signed the best-practices UN document.) Domestic managers have been busily launching funds, too, with more than 65 new offerings since 2005, according to Strategic Insight. ETF's are beginning to emerge as well, as you might expect. For example, FaithShares launched three new faith-based ETFs in mid-December 2009, targeted at Christian investors.

Worth A Look

Given the numbers, the sector is worth a close look. Open-minded skeptics will be pleased to hear that Darwin's mantra of “adapt, migrate, or die” is indeed in play in this area of the investment world. For many investors and fund managers, socially responsible investing has evolved into the broader practice of evaluating a company's impact on the environment, its social impact, and its corporate governance practices (referred to as “ESG”) along with its financial status. It stands to reason, SRI advocates argue, that well-managed firms with effective governance and sound environmental practices will do well as investments.

We believe that this next step in the evolution of socially responsible investing (SRI) will support the growth of both SRI and ESG investment products in the short term. Over the long-term, we believe that ESG will become core to the investment selection process for virtually all money managers. Ultimately, that may change the landscape and lead to consolidation of SRI and ESG managers.

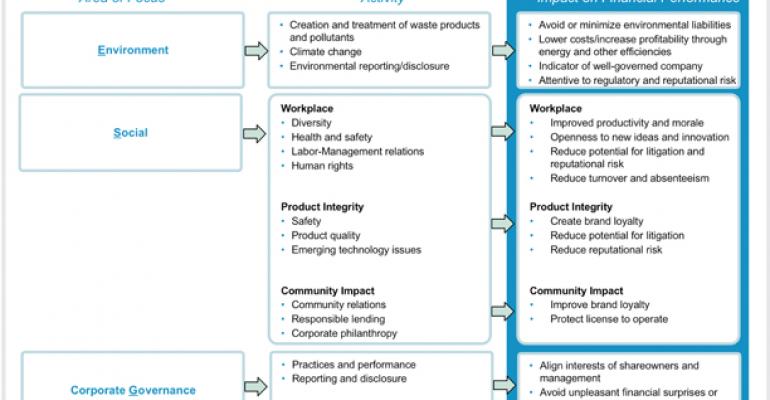

As an example of how this evaluation process can work, take at look at the way PAX World, the Portsmouth NH-based manager of more than $2.5 billion in ESG assets, views the impact of sustainable investing on financial performance.

Financial advisors, in our view, have an opportunity to use ESG and SRI funds to both deliver the returns that clients expect and require, and to take advantage of some more subtle elements of these products to reinforce client relationships.

One of these is trust. Trust, we feel safe in saying, is in rather short supply these days. And understandably so. Advisors are skeptical of product manufacturers, and clients are equally skittish about the financial services business overall. Funds and products that offer investors an uncomplicated message such as “we take the obvious into consideration when selecting investments for our fund” have an opportunity to use that message to connect with wary investors. (See chart.)

Here's another way to think about the benefits of putting responsible investment funds in your clients' portfolios. Wealth managers and several large brokerage firms have recognized the importance of charitable giving to their clients. Witness the remarkable growth of the Fidelity Charitable Gift Fund and Schwab's competing offering. These solutions allow the firms to partner with their clients in philanthropic activities, which deepens understanding of clients' values and commitments. This kind of close personal engagement supports long-term client retention, cross-selling, and referrals. Advisors can use this same concept to deepen relationships by discussing and selecting funds that use ESG metrics. Recent research report from institutional investment consulting firm Mercer (Shedding light on responsible investment: Approaches, returns and impacts, November 2009) catalogues sixteen recent academic studies on the impact of ESG elements on investment results. (See chart.)

A Word About ESG

Environmental, social and governance factors include a host of items including how a company manages its environmental impact (emissions, disposal, energy use, and so forth) and how it deals with natural resources such as water. On the social front, metrics can include community investment, giving programs, and employee volunteerism. Corporate governance items can include board effectiveness and independence of members, risk management, and communications.

The RepThinkTank, a research consulting unit of the magazine, recently completed a quarterly trend survey of more than 500 financial advisors to gauge perspective on a number of issues including confidence and trust in the money management firms providing the products advisors use to build client portfolios. Advisors were asked to rate their feelings of trustworthiness on a scale of 1-6, with 1 meaning “not at all trustworthy,” and 6 meaning “completely trustworthy.” The chart above shows the percentage of advisors who rated each type of firm a 5 or a 6.

In this era of social awareness and responsibility, the growth in responsible investing is completely understandable. Retail investors drove the early growth in socially responsible mutual funds from small, boutique managers. Today, institutional investors, their professional advisors, and asset managers are incorporating ESG metrics into their security selection processes. Advisors have a great opportunity to take advantage of this changing landscape to reinforce client relationships by adding another dimension — environmental, social, and corporate governance — to their toolkit of portfolio management approaches.

Writer's BIO:

Lisa Cohen is the CEO of Momentum Partners, which provides specialized and objective advisory services to industry leaders who want to drive growth and innovation.

[email protected]