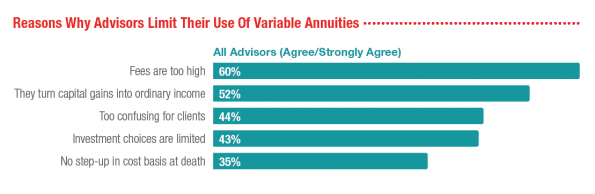

Advisors largely agree on the reasons variable annuities are useful—as well as the reasons they may not be. The number-one reason advisors limit their use of variable annuities: high fees, according to 6 in 10 survey respondents. The second-most-common reason was unfavorable tax treatment, specifically that variable annuities convert capital gains into ordinary income. Advisors also reported that they limit use of the products because variable annuities are simply too complicated for clients. According to one RIA based financial planner with nine years of experience, “They are very complicated, often difficult for even financial professionals to understand completely.”

The concern that variable annuities are too complex for clients (and possibly even some advisors) aligns closely with the objections advisors say their clients’ raise against the products. Top client concerns reported by advisors include high cost, lack of liquidity and complexity.

Next Part 4 of 4: Looking Ahead

Click to Enlarge

Click to Enlarge