Moving from a commission-based business to one based on fees, advocates argue, removes conflicts and puts advisors on the same side of the table as their clients.

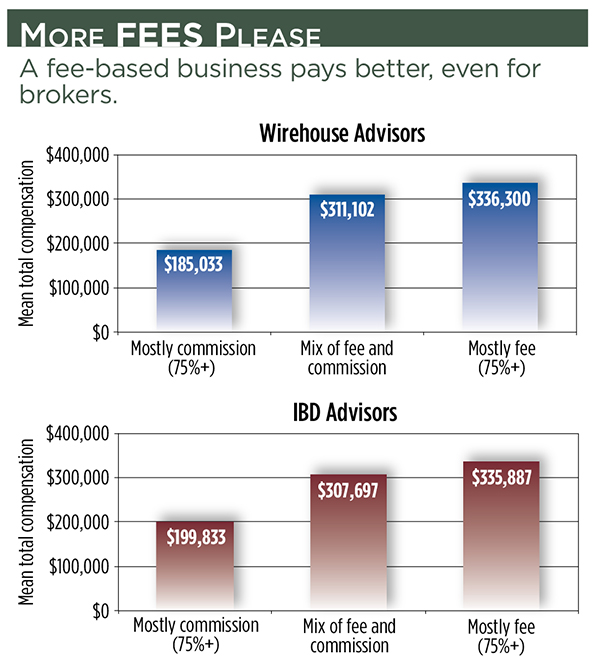

It also pays better. A lot. According to WealthManagement.com’s annual compensation survey, even at the wirehouses, advisors whose business mix leans more toward fees make almost twice those who still lean heavily toward commissions.

“You’re not even trading off compensation for stability,” says Gary Shub, a partner in the financial services practice of The Boston Consulting Group. “A fee-based business offers a steady stream of recurring revenue, and the compensation level ends up being higher. We still talk about fee-based as a trend, but the reality is it’s certainly more than 50 percent of the revenue of the business.”

The Shift to Fees

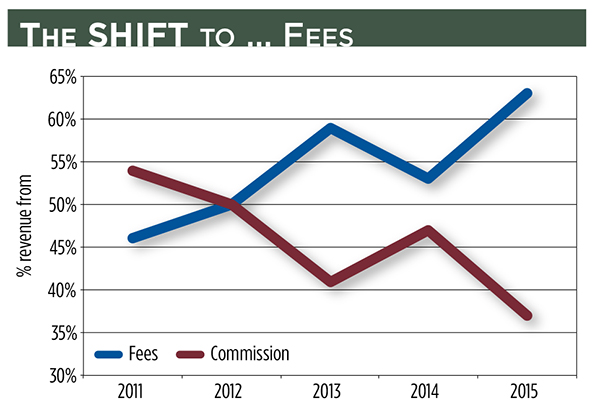

Five years ago, fees accounted for less than half of all advisors’ revenue. But last year, advisors derived about

63 percent of their revenue from fee-based business and about 37 percent from commissions, according to the 2015 survey in which almost 950 advisors from all channels participated in April.

Among wirehouse and independent broker/dealers, advisors reported generating, on average, about 60 percent of their revenue from fee-based businesses.

And why not? Wirehouse advisors who have more than 75 percent of their business in fees earned an average of $336,300. Those who based more than 75 percent of their business on commissions earned an average of $185,000. The same held true for advisors at IBDs. Those with a majority fee-based business earned an average of $335,900, compared to those with a predominately commission-based business generating just $199,800.

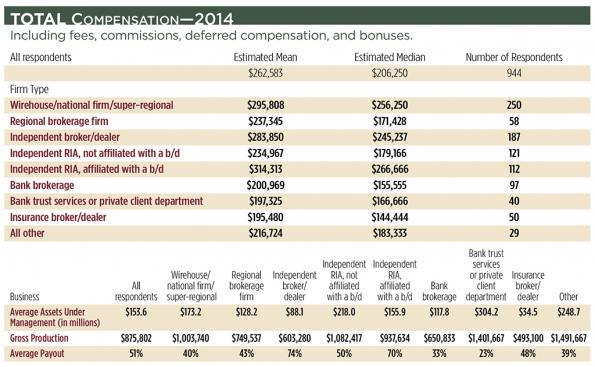

Overall, financial advisors saw their compensation grow by 12 percent to an average of $262,600 last year, according to the survey. Total compensation was up from the previous year for more than seven out of 10 advisors; almost a third said it was up by more than 20 percent.

Hybrid advisors working at an independent registered investment advisory firm affiliated with a broker/dealer took home the biggest paychecks in 2014—about $314,300 on average, according to the survey results. Wirehouse advisors came in second with an average $295,800 in total compensation reported, followed by advisors at IBDs with $283,900.

Total Compensation 2014

“Over the last several years, we’ve seen very little growth in the number of advisors. But if you look beneath the surface, the overall quality of the advisors has risen,” says Dan Inveen, principal and director of research at FA Insight. “(Fee-based business) is a more complex type of business and it’s not an easy transition.”

But for those who are capable of it, the benefits are tangible.

Overall, advisors saw a 15 percent bump in assets under management, outperforming the S&P 500’s 12 percent rise last year. The average advisor had about $154 million in client assets under management. While hybrid RIAs experienced the highest level of growth with a 19 percent increase in client assets, all advisor channels increased their level of assets under management within a few percentage points of one another.

“Who is actually successfully working to increase assets and not just riding the wave? This is a troubling trend,” says Matt Lynch, founder of the Ohio-based consulting firm Strategy & Resources.

While market impact was likely the dominant driver of the 15 percent AUM growth, BCG’s Shub says fee-based advisors seem to be better at consolidating assets.

“They’re not just winning new clients into the fee-based model, but then over time (they) are able to attract the clients’ assets that may have been held elsewhere,” he says.

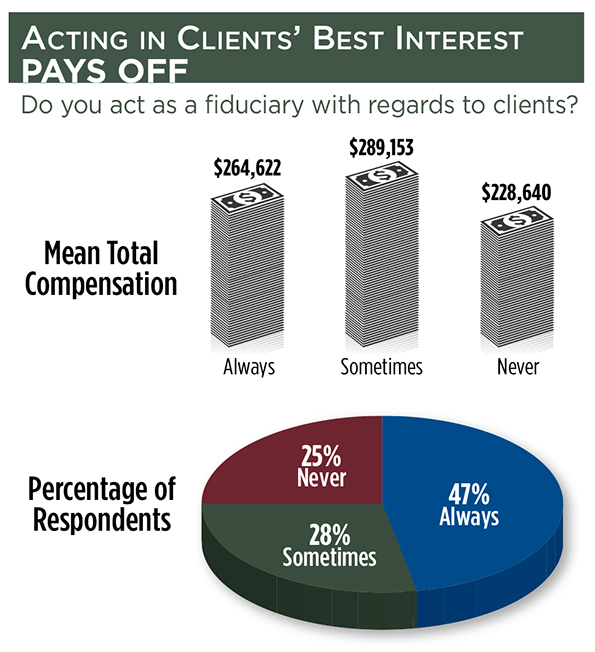

Being a Fiduciary Pays Off

According to the survey, advisors across all channels increased the number of clients they serve by 8 percent; pure RIAs (those not affiliated with a b/d) grew the client base 10 percent, and hybrid advisors by 9 percent.

Excluding market performance, 78 percent of advisors said clients invested more money than they took out over the past year. Only 7 percent of advisors overall saw more money leave their firm than come in.

'Outlook Looks Pretty Good'

Advisors are optimistic the trend will continue, anticipating they will grow their total take-home pay by another 12 percent in the upcoming year. “If you’re an employee-based advisor, the outlook looks pretty good because all the signs point toward continued healthy growth in the rate of compensation,” Inveen says.

But Lynch questions how optimistic advisors should really be. “Everyone thinks their compensation will grow about the same year over year, but I wonder what percentage of that growth is tied to new business, compared to those who are expecting to just ride the wave of market action,” Lynch notes.

Firm owners may also have cause for concern. “If you’re a firm owner, however, you should probably be a little concerned about how you’re going to source labor and manage higher costs related to compensation of your staff,” Inveen cautions. While the market demand for advice continues to grow, the supply of advisors has not.

About 37 percent of advisors participating in the 2015 survey reported being an owner or principal of a firm. Half of the pure RIA respondents and 66 percent of hybrid RIAs reported being an owner or principal.

Next: Can the Hourly FA Survive?