Investors who concentrate in American stocks are hobbling themselves because the U.S. ranks just 12th in the world for economic freedom. They can do better overseas in nations devoted to these freedom principals, such as limited government, the rule of law, open markets and regulatory efficiency.

At my firm, we are strong advocates of index investing. But which index funds? There are about 1,500 of them. Many follow the Standard & Poor’s 500, which represents just half an asset class, large-company U.S. stocks. Other funds follow obscure indexes such as the Market Vectors Colombia (COLX), an exchange-traded fund that tracked stocks from that South American nation (and closed in December).

We use several country specific funds to over-weight the countries with the most economic freedom, according to the Heritage Foundation’s Index of Economic Freedom. Between 2000 and mid way through 2014, countries high in economic freedom outperformed both the EAFE foreign index and the S&P 500. Economic freedom matters, and despite dropping out of the free category in 2010, the United States still ranks among the freest countries in the world.

Freedom investing makes sense. Libertarians and economists both recognize that countries with more economic freedom experience higher growth of gross domestic product.

We’ve analyzed freedom investing by its returns. But how do countries with the most economic freedom correlate to each other? Do they move more in sync with the United States or the EAFE index? (EAFE follows stocks in the developed world outside of North America – in Europe, Southeast Asia and Australia.) Should we have a “Free Countries Asset Class” or a “Foreign Stock Asset Class”?

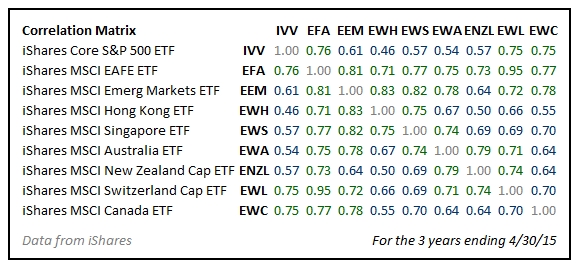

To answer that question, I analyzed the correlation between two ETFs, the iShares Core S&P 500 (IVV) and iShares MSCI EAFE (EFA), against the six countries that ranked the highest in economic freedom: Hong Kong, Singapore, Australia, New Zealand, Switzerland and Canada.

Here are the correlations over the past three years, through April:

Interestingly, the average three-year correlation of the EAFE vehicle to these six countries is 0.78, while the average correlation of the S&P 500 one to the same six countries is only 0.61.

I think this 0.17 difference in correlation definitively answers that freedom investing belongs in the foreign stock category rather than in an asset class with the United States.

In fact, the average correlation of each of the six countries with the other five is higher than the average of their correlation with the United States: Hong Kong (0.63), Singapore (0.71), Australia (0.71), New Zealand (0.67), Switzerland (0.70), and Canada (0.65).

This chart shows that the United States and Canada often move in sync with each other with a 3-year correlation of 0.75 and that Australia and New Zealand also mirror each other with a three-year correlation of 0.79.

Perhaps most interesting is the 0.95 correlation between Switzerland and the EAFE foreign index. As of the end of March 2015, the three-year annualized return of iShares Switzerland Capped (EWL) has been 12.69%, while the return of iShares MSCI EAFE (EFA) has only been 8.92%. I suspect that this is because though the two indexes have moved similarly for the last three years, the Swiss currency has held its value better against the dollar each year by 3.77%.

Much like resource stocks, foreign investing boasts diversification in its underlying assets even greater than it does as an asset class as a whole.

In a separate article we showed that the correlation between different styles of U.S. stocks (large-small, value-growth) reveals less diversification than we’ve just found in freedom investing. For this reason, advisors who have a U.S.-centric investment philosophy and just a generic allocation to foreign stocks miss an important opportunity to diversify their portfolios.

Follow AdviceIQ on Twitter at @adviceiq.

David John Marotta, CFP, AIF, is president of Marotta Wealth Management Inc. of Charlottesville, Va., providing fee-only financial planning and wealth management at www.emarotta.com and blogging at www.marottaonmoney.com. Both the author and clients he represents often invest in investments mentioned in these articles.

AdviceIQ delivers quality personal finance articles by both financial advisors and AdviceIQ editors. It ranks advisors in your area by specialty, including small businesses, doctors and clients of modest means, for example. Those with the biggest number of clients in a given specialty rank the highest. AdviceIQ also vets ranked advisors so only those with pristine regulatory histories can participate. AdviceIQ was launched Jan. 9, 2012, by veteran Wall Street executives, editors and technologists. Right now, investors may see many advisor rankings, although in some areas only a few are ranked. Check back often as thousands of advisors are undergoing AdviceIQ screening. New advisors appear in rankings daily.